On Feb. 12, Harmanpreet Kaur got a call in the middle of the night from her business’s alarm company. The fire alarm was going off, but it wasn’t anything unusual.

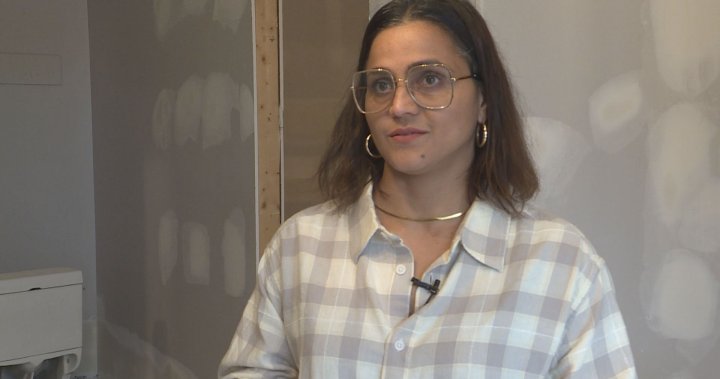

“We thought it was a false alarm because it has happened before,” she said.

When she awoke the next morning, her landlord called, telling her worst nightmare had come true.

“She said no, your spot is on fire,” Kaur said. “That was, like, the most devastating news I ever work up to.”

Since the fire, Kaur has been busy coordinating with contractors to get her Corydon Avenue business, Spa Botanica, ready to reopen. But it’s been a stressful — and expensive — process.

Kaur’s business was under-insured. Although much of the spa’s equipment and products weren’t damaged in the fire, Kaur learned she needed to be insured for their total value to get full coverage. She estimates she’s out roughly $50,000 in odds and ends she hadn’t added to her policy.

“I just did not know,” she said, “and I wish someone had explained it better.”

Financial news and insights

delivered to your email every Saturday.

Rob De Pruis with the Insurance Bureau of Canada says it’s common for businesses to opt for lower premiums, but run the risk of less coverage in an emergency.

“Co-insurance is essentially a cost-sharing arrangement that a person has if there is a decision or they’re not insuring to the full policy limit,” he said.

“You’re essentially taking on some of that risk yourself.”

He compares it to a prescription benefits plan:

“When you go to pick up your prescriptions at the pharmacy, your benefits provider will pay 50%, and then you individually will have to pay 50%. Business policy wordings have something similar.”

Kaur says she is left to pay nineteen per cent of cost of repairs to her business. She’s planning to reopen April 6, and urges others to check the fine print in their policies.

“We trust our broker. We trust our … insurance people. We’ve been paying them for 10 years now and hoping that they’ll cover when we need it,” she said.

© 2024 Global News, a division of Corus Entertainment Inc.

#underinsured #Winnipeg #business #owner #warns #expensive #fire #Winnipeg